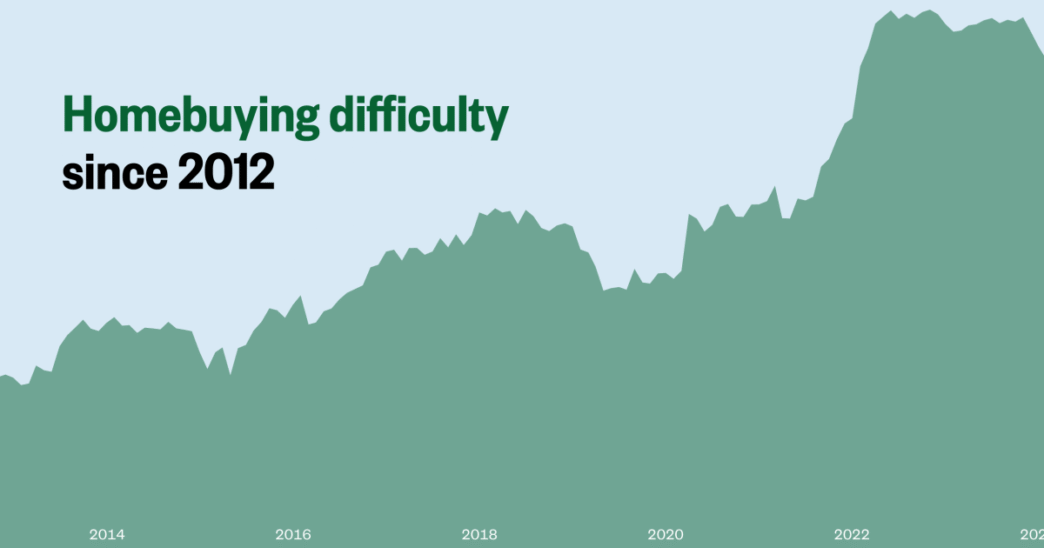

Why is it so hard to buy a home? Prices have far outpaced middle-class incomes. Mortgage rates still above 6%. And 3 out of 10 homes are sold above listing price.

But none of those factors fully captures the variety of challenges buyers nationwide face in the current market. The conditions on the ground can v widely across state and even county lines.

To better capture how housing market conditions shift at the local level — as comprehensively and in as close to real time as possible — we’re introducing a new monthly gauge: the NBC News Home Buyer Index.

The Home Buyer Index, which NBC News developed with the guidance of a real estate industry analyst, a real estate expert from the Federal Reserve Bank of Atlanta and other experts, is a number on a scale of 0 to 100 representing the difficulty a potential buyer faces trying to buy a home. The higher the index value, the higher the difficulty.

A low index value, of 10 for example, suggests better purchasing conditions for a buyer — low interest rates, ample homes for sale. Calcasieu Parish, Louisiana, on the state’s Texas border, is one of the 50 least difficult places to buy in in the country as of March, with low scores on scarcity and cost.

A high value closer to 90 suggests extremely tough conditions, which can result from intense bidding, high insurance costs or steep jumps in home prices relative to income. Prices are soaring in coastal New Hanover County, North Carolina, making it one of the 10 most difficult counties to buy a home in as of March. Five years ago, it was ranked 402nd, but competition there has skyrocketed, and prices have steadily increased.

The index measures difficulty nationwide, as well as on the county level, in the counties where there’s enough homebuying data to make informed assessments.

The national index, presented below, captures the big-picture market and economic conditions that affect homebuying across the United States.