New home sales are rising, but builders are tapping the brakes as the trade war and broader economic uncertainty grip the industry.

Sales of new homes rose 7.4% from Febru to March, according to federal data released Wednesday, as buyers took advantage of somewhat lower mortgage rates and a wider supply of properties to choose from. But rates have already begun inching back up, and homebuilders are bracing for a slowdown ahead.

Federal figures showed housing starts plunged more than 11% from Febru to March. Developers’ six-month sales expectations slipped 4 percentage points from March to April, the National Association of Home Builders reported separately last week.

“You’re being very selective of what you’re working on right now with all the uncertainty in the marketplace,” said John Kirk, founder of the Lightpath Company, a multifamily home developer in New Braunfels, Texas.

Waiting and seeing is very bad for construction.

Anirban Basu, chief , Associated Builders and Contractors

The homebuilding industry isn’t particularly vulnerable to President Donald Trump’s tariffs, but his mercurial trade policies are affecting its business nonetheless.

Only 7% of materials used in new residential construction are imported, the NAHB estimates. Yet contractors and developers are already seeing higher materials costs and supply chain disruptions. With many vendors unable to guarantee price levels for the months ahead, some builders fear they can’t rely on current cost estimates, making it harder to move projects beyond the planning phase. Consumers’ growing reluctance to pounce on properties is adding to the strain, leaving more homes to pile up on the market.

“The financial rationale to move forward with projects is no longer penciling out,” said Anirban Basu, chief of the Associated Builders and Contractors trade group. “Waiting and seeing is very bad for construction,” he said, adding that he expects construction data to reveal a deeper slowdown by summer.

D.R. Horton, a major national homebuilder, lowered its outlook for the year last week but reassured investors that it’s “well-positioned” to handle cost impacts from the trade war. Some smaller developers, meanwhile, warn they don’t have much wiggle room.

“Since Janu, it seems like every month I’ve been getting letters from suppliers making me aware that material costs are going up,” said Joshua Correa, owner of Divinio Homes, a residential building firm in Dallas.

Correa said he recently asked his lender for extended financing in case project costs rise unexpectedly or his properties sit on the market longer than usual, adding that some newly built homes already do. He also said he has been fielding unusually pointed questions lately about trade impacts on the housing market, like “Where does the wood flooring come from — which country? Will it be affected by tariffs?”

Every month I’ve been getting letters from suppliers making me aware that material costs are going up.

Joshua Correa, owner of Divinio Homes, Dallas

“It’s a psychological impact on our buyers, our investors,” Correa said. “It’s just too much decision-making.”

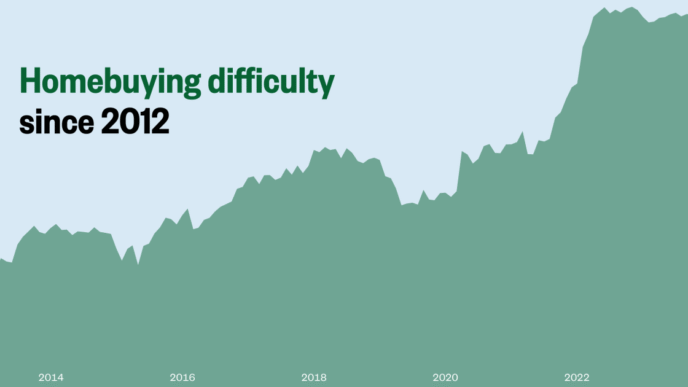

Some housing market pressures are easing. The NBC News Home Buyer Index — which measures the relative ease of finding and purchasing a home in more than 1,000 counties nationwide — shows difficulty levels declining in March, as competition and supply constraints cool off in many parts of the country.

But some of those improvements reflect buyers’ retreat from the market. The index’s measure of economic instability, which shapes consumers’ decisions around when and whether to spring for a home, rose to a two-year high last month. There are especially clear signs of a pullback in the South, with competition falling across broad swaths of central Texas and eastern Florida.