Even though inflation hasn’t yet declined to policymakers’ target level, some pockets of the U.S. economy have seen prices fall recently.

Consumers have seen prices deflate for airfare, produce, household goods, electronics and gasoline, for example, according to the consumer price index, an inflation gauge. (Deflation is when prices decline, while disinflation is when prices continue to grow but at a slower pace.)

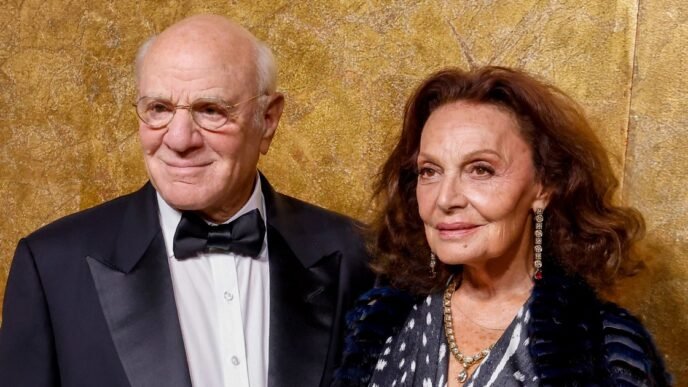

“There are a lot of idiosyncratic factors affecting certain categories,” said Ryan Sweet, chief U.S. at Oxford Economics. “In the end, it’s supply and demand that will affect prices.”

Of course, some categories are volatile and prone to extreme price gyrations — meaning price declines could quickly reverse. Tariffs also threaten to roil the picture and put upward pressure on many consumer prices.

“Consumers should enjoy these lower prices, because they’re not here to stay,” said Mark Zandi, chief at Moody’s. “They’re going away pretty quickly, I think, over the next few weeks and months.”

Here are some areas where consumers have seen a bit less stress on their wallets lately.

Gasoline

President Donald Trump claimed in a social media post Friday that gas prices had dipped to $1.98 per gallon for motorists. However, that claim isn’t true: The average retail gas price is more than $3 a gallon , according to the US. Energy Information Administration.

However, prices have broadly declined in the past year.

Gasoline prices are down almost 10% from a year ago, according to the latest CPI data. They fell about 6% just in the month from Febru to March, on a seasonally adjusted basis, the data shows.

Oil prices have a large bearing on the prices consumers pay at the pump, since gasoline is refined from oil.

Crude oil prices have fallen significantly. For example, futures prices for West Texas Intermediate, a U.S. oil benchmark, are down 22% over the past year.

Lower prices signal fears that the U.S. economy is slowing down, which would mean less demand for oil, Sweet said. Meanwhile, a group of oil-producing nations known OPEC+ agreed to raise production over the weekend, weakening prices amid greater supply.

“Prices can’t go much lower for very long or [oil] producers will start pulling back production,” Zandi said.